Recent Insight

We are proud to share our latest research, which has uncovered several key insights that provide a new perspective on the current state and future trajectory of the market.

-

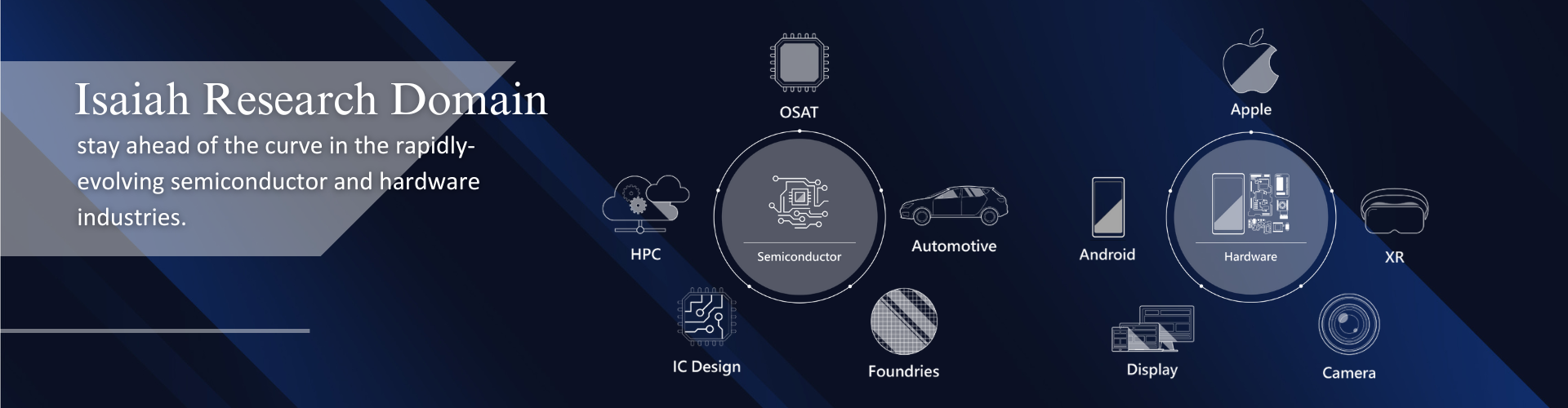

UMC 2026 Production Capacity Supply-Demand and Application Structure Analysis

This report provides a comprehensive analysis of United Microelectronics Corporation's (UMC) production capacity, supply-demand dynamics, and application structure for the year 2026. Moving beyond traditional consumer electronic cycles, the analysis highlights a structural recovery driven by a diversified application portfolio and the geopolitical "NCNT" (Non-China/Taiwan) supply chain restructuring. Key insights reveal that the 22/28nm node will serve as the profit core, maintaining tight supply (85-90% utilization) through a balanced mix of DDI, TWS, and ISP demand. The newly introduced 12/14nm process is characterized as a pilot line dedicated to communication RF applications. Meanwhile, mature processes (40nm-90nm) and 8-inch fabs are undergoing structural shifts; while MCUs remain significant, a strategic influx of PMIC and DDI orders—stemming from competitor capacity adjustments—is reshaping the landscape. The report concludes with actionable recommendations for supply chain partners, emphasizing the importance of monitoring RF test interface demand and the timing of 8-inch order transfer effects.

Read More -

2026 Global Smartphone AP Market Outlook: Product Layout and Pricing Stakes Amidst Supply Chain Headwinds

The 2026 smartphone Application Processor (AP) market faces a pivotal year of transformation. Isaiah Research projects a 2.5% YoY decline in shipments, driven by a "double squeeze" from soaring memory costs and T-Glass substrate shortages. While Apple shows resilience with explosive growth potential for the A20 Pro in high-end and foldable segments, Qualcomm and MediaTek are pivoting toward aggressive cost-control and legacy platform strategies to survive a polarized market. This report analyzes the strategic shifts between TSMC and Samsung Foundry, the return of Exynos, and the cutthroat pricing battles defining the mid-to-low-end landscape.

Read More -

Industrial Data Update: iPhone Production Forecasts Continue to Surpass Historical Peaks

2025 Annual Revision: Isaiah Research has upwardly adjusted the total iPhone production forecast for 2025 to 247–249 million units, a notable increase from the previous November estimate of 245–247 million.

Read More -

Analysis of Wafer Consumption per 1 GW Deployment of Nvidia VR200 NVL144 and Evaluation of TSMC's Front-loading Strategy

As AI computing scales from single-chip performance to data center energy evaluations measured in Megawatts or even Gigawatts (GW), semiconductor supply chain capacity planning faces unprecedented challenges. This report provides an in-depth analysis of wafer consumption for Nvidia's next-generation VR200 (Vera Rubin) architecture per 1 GW deployment. Analysis indicates that demand for 3nm (N3) wafers for the VR200 generation far exceeds expectations, with a single GW of deployment potentially consuming over half of TSMC's total N3 capacity. To meet 2027 deployment demands, the supply chain must adopt a "front-loading" strategy, initiating inventory build-up as early as early 2026. This report explores this supply-demand imbalance, technical node transition challenges, and the profound impact on future High-Performance Computing (HPC) capacity allocation.

Read More

Newscenter

Explore and access our press releases, media coverage, as well as insights from our experts on a wide range of tech topics.

-

Exclusive: After US curbs, Tencent and small chip designers chase Nvidia's China crown

Should Chinese chip designers win orders, they could still struggle for production capacity given constraints U.S. curbs put on foundries such as TSMC (2330.TW) from working with Chinese firms, said Isaiah Research Vice President Lucy Chen.

Read More -

How TSMC and other firms making the most advanced semiconductors are getting a reprieve from Biden’s chip war on China

The waiver is “good news” for TSMC, as it allows the company to continue with expansion plans for its 28-nanometer chips in Nanjing, China, says Lucy Chen, vice president of Isaiah Research, a Taiwan-based tech-research firm.

Read More -

China’s Apple loss is India’s gain, as 2022 supplier list shows shift in supply chain preferences

Apple added five new mainland Chinese suppliers while removing eight in mainland China in its latest financial year ended September 2022, after China’s strict Covid-19 controls disrupted iPhone production last holiday season, according to the latest supplier list published by the US consumer electronics giant.

Read More -

The next iPhone will still be made in China, but Apple’s main assembler Foxconn will have to share the work, report says

Foxconn may lose some iPhone 15 work to other Chinese manufacturers after it failed to deliver iPhone 14s last November due to Covid disruptions. New arrangement marks the first time Apple has tapped three suppliers to produce premium iPhones, highlighting efforts to smooth the supply chain

Read More

Clients Network

Contact Us

Let our sales and analyst team help you find the right service and insight for your business.